How to get start-up funding

Are you a visionary entrepreneur with a groundbreaking hardware innovation, eager to bring it to life but facing financial hurdles? Securing the necessary capital for hardware development is a well-known challenge for many entrepreneurs embarking on startup ventures. The encouraging news is that, armed with an effective business model and a compelling pitch, you can raise funding and lay the foundation for a thriving and scalable business. ManGo has been a trusted advisor to numerous startups, offering guidance on strategies for start-up funding and product development. In this blog, we highlight essential factors to consider when approaching investors, ranging from determining the funding amount to crafting an impactful pitch deck.

Why seek start-up funding?

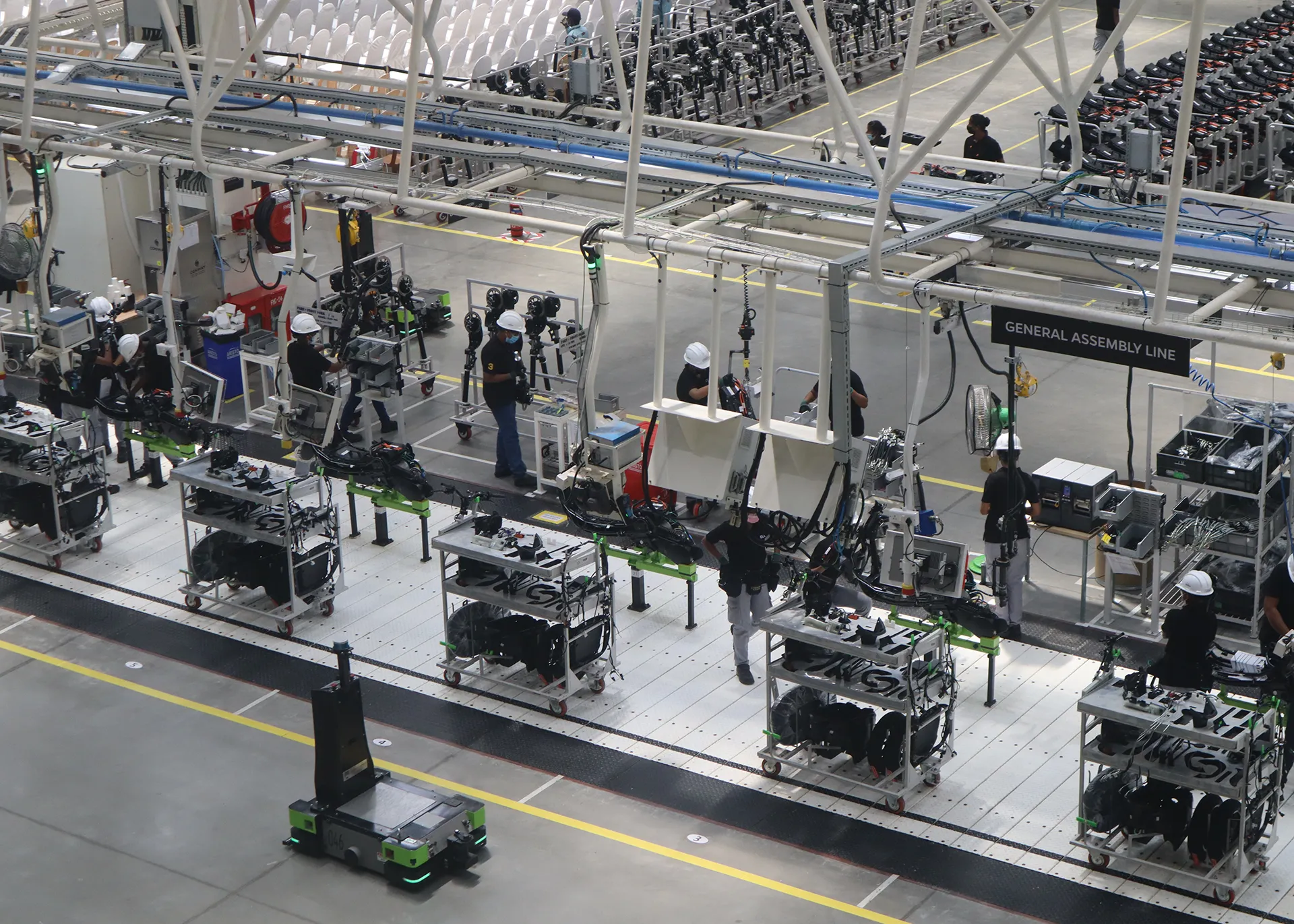

Investments are the lifeblood of most hardware startups. From the early stages of prototyping to manufacturing, investments are essential to create a successful and scalable business. Even when all funding is secured, and you have the liberty to proceed at full throttle, the development of a hardware product typically extends beyond a year. Once the design is finalized, tested, and certified, the process of industrializing your invention with factories can be even more time-consuming. Moreover, investments required during this journey incrementally grow with each progressive step until the market introduction. Filling a warehouse with your new products comes with significant costs. However, given that products don’t inherently sell themselves, it’s imperative not to overlook the necessity of a marketing budget to broadcast information about your product and company to the world. This is why you often encounter news of startups or scale-ups raising funds. Each achieved milestone, such as a working prototype, enhances the company’s value, making it possible to get additional funding for the next crucial step.

Different types of investors

There are different types of investors that you can consider for your start-up funding, the stage of your company and required investment mostly determine which is most interesting for you.

Friends, family, and fools

The most straightforward approach to initiate fundraising for your hardware development is to seek investments from friends and family. This fundraising method is commonly referred to as the “friends, family, and fools” round, also known as F3 investors. Friends and family are often inclined to invest in your startup not solely for the potential financial return, but because they have faith in you and your idea. While their investment amounts may not be substantial, they can provide crucial support to get your venture off the ground. F3 investors also tend to be more flexible regarding repayment terms, with fewer legal requirements and formalities. However, it’s essential to recognize that investing in a startup carries inherent risks, and if the business encounters difficulties, it could strain relationships with friends and family.

Business angels

Business angels, wealthy individuals eager to invest in startups, differ from venture capital firms in that they typically invest personal finances. Leveraging their seasoned entrepreneurial backgrounds, they not only contribute funds but also extend guidance and mentorship. When considering a business angel, it’s prudent to look beyond their monetary contribution and consider their background. Drawing from experience in a similar field, they can bring extensive networks, deep knowledge, access to potential customers, and insights to steer clear of pitfalls. Generally, more patient investors, they tend to hold a smaller equity stake than venture capitalists. However, their focus typically lies in seed funding, reaching up to 100K (in euros or dollars), and they might be less inclined toward follow-on investments. Given the similarity to a marriage, it’s crucial to consider the strength of your personal connection with the business angel. Conduct thorough research on their background and past business ventures. Additionally, ensure that the investor has the necessary time commitment available to invest in and support your startup as well. ManGo has access to a vast network of angel investors to whom we can introduce compatible startups.

Banks

Banks provide diverse financing alternatives such as venture debt, lines of credit, and asset-backed loans. For hardware companies seeking a dependable source of startup funding with structured repayment plans, bank loans can be a viable option. However, banks typically demand a proven track record of success and collateral, which can be challenging for early-stage startups without established histories. While this type of investment usually incurs lower costs and does not entail giving away shares, it may impose limitations on your growth potential. In our experience at ManGo, we observe that banks become a more favorable source of credit you’re your business is more established.

Venture capital

Venture capitalists (VCs) are professional investment funds actively seeking high-growth potential startups or scaleups. Their typical investment occurs in later stages, often when revenue is well-established. VC firms provide substantial funding along with valuable resources, including mentorship, talent acquisition support, and a robust network. However, engaging with VC’s entails thorough scrutiny, and founders must meet specific criteria, such as demonstrating management expertise, a proven business model, and a clear path to profitability. It’s crucial to note that raising funds from a VC involves relinquishing a significant portion of ownership, potentially leading to a loss of control. Additionally, VC firms necessitate an exit strategy, indicating a requirement for you to sell the company in the future when they deem the moment optimal to do so (maximum profit).

Crowdfunding

Crowdfunding can serve as an excellent means for emerging startups to engage with potential investors and consumers. However, it is essential to acknowledge that this type of fundraising has experienced a significant decline in recent years. Largely attributed to many campaigns failing to deliver the promised product to backers. Participating on well-known platforms like Indiegogo or Kickstarter requires showcasing a functional prototype and providing substantial content for approval. Startups must also vigorously promote their campaigns on social media to gain sufficient traction. Common pitfalls in this approach include underestimating the required startup funding, often due to a lack of knowledge about the costs involved in progressing from a prototype to market introduction. Combined with overly ambitious promises for market entry, patent infringement claims, and production costs exceeding initial estimates, these factors can create a cocktail for disaster. At ManGo, we recommend utilizing crowdfunding campaigns as a supplementary marketing channel rather than relying solely on them as your primary investment strategy.

Finding investors

In the pursuit of raising funds, expanding your network is essential to identify suitable investors. Begin by reaching out to your current contacts, encompassing friends, family and colleagues. Extend your reach by participating in networking events, conferences, relevant tradeshows and pitch competitions. Utilize social media like LinkedIn and Twitter to connect with potential investors. Prioritize investors with a track record in hardware development startup funding or with experience in related industries. Partner with accelerators and incubators offering mentorship, early-stage funding and introductions to their investor network. Following your pitch, promptly follow up with investors to gauge their interest and address any queries. Even if they’re not interested, seek feedback for potential improvements. At ManGo, we boast an extensive network of hardware investors, allowing us to connect suitable startups with potential backers. Based on our experience, the most successful startups often have a team member devoted full-time to raising funds, as it is a lot of hard work.

CRITERIA OF INVESTORS

Before you start pitching your design, it is wise to investigate and understand what investors look for in a startup or scale-up.

TEAMWORK

Business model

Ensuring your business model is appealing to investors is crucial, as they seek assurance that their investment goes into a scalable venture with long-term potential. Your business model should articulate a strategy for revenue growth, profitability, and address potential risks or obstacles to success. A robust business model stipulates revenue streams, market trends, competitors and your solution’s integration into the industry, among other aspects. A particularly successful model for hardware startups is the subscription business model, where customers pay a monthly fee for product usage or derived data. This Product As A Service (PAAS) approach establishes a consistent flow of recurring revenue, fostering customer loyalty, and ultimately leading to higher retention and investment levels.

KNOWING YOUR FUNDING REQUIREMENTS

Percentage of shares to give away

Entrepreneurs often struggle with the challenging task of determining the value of their business, which complicates the process of deciding the appropriate equity share to offer. Investors typically seek ownership of 10% to 50% in startup funding. However, the specific percentage is dependent on various factors, including your business stage, previous funding, and the potential for future growth. When determining the funding amount and the percentage of shares to allocate, it’s crucial to align with your long-term goals. Beyond meeting immediate financial needs, consider the capital required for long-term objectives and the corresponding equity you’re willing to part with. Maintaining a realistic company valuation is essential to avoid frustrating potential investors and driving them away.

The pitch deck

A good pitch deck is visually engaging, easy to follow, and encompasses all vital information about your product. Ensure that your pitch deck clearly outlines your vision, the identified problem, your target market and the solution you offer. Highlight team strengths, experience, skills, and your marketing and sales strategy. Emphasize the potential for return on investment (ROI) with a well-defined plan. Keep it simple, focus on the core idea—your pitch deck should effectively sell your product in under two minutes. In the pursuit of startup funding, the pitch deck acts as the key to opening doors. Given that investors daily review numerous such documents, it’s imperative to incorporate visually appealing graphics and limit text. Aim to keep your deck within 10 to 20 pages, ensuring brevity and impact.

Pitching

Upon receiving an invitation to pitch your design, it’s beneficial to practice and refine your presentation with input from a small audience. Ensure that your pitch fits within the allocated time and is not only informative but also engaging, inspiring, and meticulously crafted to present an investment opportunity aligned with investors’ interests. When you’re prepared, exude confidence and firmly support your idea, bearing in mind that investors invest not only in your concept but also in you and your team. Additionally, anticipate a critical and thorough Q&A session by brainstorming tough questions with others and preparing well-thought-out answers. It’s crucial to avoid getting into arguments with potential investors. Also, it’s wise to gain insights from attending a few pitching events and closely studying successful presentations on shows like Shark Tank or Dragon’s Den.

Conclusion

Securing investment for product development is often a crucial step on the path to building a successful business. From networking at events to crafting a business model and understanding how much money to ask for and what percentage of shares to give away, there are many factors to consider. However, with a clear plan, a strong understanding of your business and industry, and a willingness to be transparent and honest, you can find investors who believe in your vision and provide the funding you need. ManGo has supported numerous entrepreneurs in pitching designs and raising funding across diverse sectors, ranging from medical devices to automotive, and from clean energy solutions to electronic devices. We are here to provide assistance and guidance in your fundraising journey.

More information

Do you also want to develop a product and need to be informed about the development costs for startup funding? Contact us by phone, our online form or send an e-mail to: